THE BLOG

You’ve had two years ....

From The Garden of Earthly Delights by Hieronymus Bosch. Painted between 1490 and 1510.

This doesn’t feel like the time for beating around the bush. Hard on the heels of a global pandemic we now have a major war in Europe. Something I did not think I’d see in my lifetime. Probably because I had not been thinking hard enough. Maya Angelou had a point when she wrote “When someone shows you who they are, believe them the first time.” Complacency has consequences.

In April 2020 I wrote a blog post quoting Lenin’s famous phrase “There are decades where nothing happens; and there are weeks where decades happen.”. Two years later, for very different reasons, we are in another such time. The first was most likely a natural ‘Black Swan’ event, the latter the result of one man’s whim. Combined, the world will never be the same again. Not least of all, it will become more serious, as we have many challenges ahead.

Easy as it is to allow the magnitude of events to overwhelm us, we are where we are. And we need to recalibrate. What do we know, what do we not know, and what should we be doing?

What we don’t know of course is when the war will end, and how. And for most of us we can but pray for the least worst outcome. We have little agency in the matter. So we need to focus on what we do know.

First off, we know the war is having a dramatic impact on the price of many commodities, and these will have knock on effects throughout society. For every individual, every family, many of their staple purchases will become significantly more expensive. Not least of all utilities and fuel. Heating and transportation costs are set to soar.

So just as we were approaching the time to ‘return to office’ a major impediment has appeared. Adding the cost of commuting back into peoples already strained budgets is not going to be welcomed. For two years many people have not been incurring thousands of pounds of commuting costs. The bar for demonstrating why being in the office is worthwhile is getting ever higher. As of course is the cost of actually running said office.

The bar for explaining why sustainability and energy efficiency is important though has dropped to almost nothing. War in Ukraine, and the knock on consequences for global energy supplies, has jolted all of us into realising that our very freedoms are imperilled by not having a robust, resilient, mostly renewable energy supply under our control. Sure there are some, like the despicable Nigel Farage, trying to use the same argument to justify ramping up fossil fuel use, but these are the chunterings of fools. The most obvious first order consequence of war in Europe will be the turbo charging of efforts to grow renewable energy production, massive investment in new battery technologies, and pushing to decarbonise the built environment. Supply has to grow and demand has to decrease. As a matter of urgency. In the short term we will have to activate fossil fuel supplies that we’d let wither on the vine, but doing so will only undergird the need to bolster renewables and decarbonise.

The implications for real estate could not be clearer. There will be a significant premium for highly sustainable assets and an increasingly significant downgrading of those that are not. Of course this was happening anyway but what we thought would take a decade or two needs to be done in a matter of a few years. Can’t be done? Well neither could persuading Germany to spend a €100 billion on their military. Make no mistake, these are now different times. Anything is possible when the largest economies in the world decide something is necessary.

Forget all the talk of ESG ‘Greenwashing’ - gaming the system is going to die out very fast. Real Estate’s number one priority is going to be decarbonisation. Partly because governments, and societies, eyes are going to be on us, but mostly because running our assets is set to become really really expensive.

Sustainability is a systems problem. Even a system of systems problem. It cannot be achieved whilst thinking and operating in silos. Everything is connected to everything else. It needs to be the flag in the ground around which everything else is designed. If we want X output what does that imply for inputs A, B, C, D…. Where A, B, C or D might be hardware, software or services. That might be under our control or under the control of one of our partners, suppliers or customers. Who also might have entirely different incentives or motives to ourselves.

Historically this rapidly got us to ‘too difficult to deal with’, so we didn’t. This is no longer acceptable. This industry needs to deal with the ‘too difficult to deal with’ problems. We need to stop thinking of ourselves as cogs in the wheel when, in reality, we are the wheel. Almost everything in the world happens in, or to, real estate.

The tragic events in Ukraine must be a catalyst for action. Being dependant on murderous dictatorships for energy is a grave weakness. Real estate is responsible for 40% of our energy needs. And 30% of carbon emissions. Both need to be slashed. As a matter of urgency, not long term aspiration.

And I haven’t even got to what we’ve had two years to think about. That’ll have to wait until next week.

Do you want to sell sugar water all your life?

Sun Setting over a Lake, c.1840-5 - JMW Turner- Tate Gallery

On Linkedin recently I read a quotation from a ‘prominent, global tech venture capitalist’ that “Top tech talent is not that interested in the CRE sector. It is not viewed as exciting for them”. Well, that’s not good is it? If true, which mostly it probably is.

But why is it so? And what can we do about it?

Let’s start with where ‘Top Talent’ does go. Some goes, not surprisingly, to wherever the money is. Not always but often that coincides with where they can leverage their talents most effectively, which mainly leads to ‘Big Tech’, who have the most data and the biggest audiences. A sizeable percentage go into academia or ‘Deep Tech’ companies working at the cutting edge of such areas as AI or Synthetic Biology.

Above and beyond all of this though, the very best go to where ‘the story’ around the work they’ll be doing is the most compelling. Where they believe they are working on creating the future, or ‘changing the world’. A cursory knowledge of the crypto scene demonstrates this; the space is awash with people proudly taking the ‘red pill’ and immersing themselves in a cultish conviction that they are the ones who ‘get it’. Sectors that captivate people attract the best. They also attract the worst of course and many mistake enthusiasm for talent, but to find the very best talent look at those industries or professions where real meaningful impact is in the very nature of what they do.

So the real estate industry should be awash with top tech talent. After all no industry has as direct an influence on the health, happiness and productivity of people as does real estate. All the people of the world are inside real estate some 90% of the time, and the space directly around them has a defining emotional, social and functional impact on them. If you want to change the world nothing beats real estate.

Or at least, nothing should beat real estate. But it does. Why?

Because as an industry we have too few people who care to make it so.

In 1983 a 27 year old Steve Jobs was looking for someone to replace him as Apple’s CEO and help grow the company. He reached out to the acclaimed marketer John Sculley, who was then President of Pepsi. Sculley was hesitant and unsure. Jobs then unleashed his now famous line: “Do you want to sell sugar water for the rest of your life, or do you want to come with me and change the world?”

That entreaty to ‘change the world’ did the trick and Sculley signed on the dotted line.

Ultimately Jobs and Sculley fell out but it is the storytelling power of ‘come with me and change the world’ that is what matters. Jobs had a vision of what he wanted to create and that stood atop all other considerations.

I have written before about his other line that one must ‘start with the customer and work back to the technology’ but this demands a caveat. It’s not just about giving your customer what they want but rather giving them what they want as imagined by yourself. You have to have your own vision before being able to satisfy someone else’s. In fact you are trying to impose your will on your market. Your conception of what is excellent, or beautiful, or unique, or simply perfectly formed in every way. Yes you have to understand your customers wants, needs and desires but those are ephemeral things. Your job is to create something that adheres to your vision whilst also delighting your customer. At the edges of brilliance customers don’t know what they want until it is given to them. Real leaders, individuals and/or companies, want to create products and services that reflect their vision first. Starting with a vision is the killer app. Only the best do.

Which is what is needed in real estate. After several decades of cookie cutter developing of product that ticks the boxes and broadly gives customers what they need, we are entering the era of having to give customers what they want. To get people into our offices, or shopping in our shops, or paying a premium for our homes, the real estate industry needs to start appreciating and encouraging its visionaries. We need people as committed and convinced of the rightness of their vision as Jobs was at Apple. We need more people prepared to put a stake in the ground and declare that what they are building is as good as it gets. We need people who see the vast opportunity there is in real estate to both get rich and to improve the lives of hundreds, thousands, millions of people.

We know how to design beautiful buildings. We know the desperate need to decarbonise the built environment, and we know how to enable people to be happy, healthy and productive, their best selves, inside real estate. We even know that, though rare, enlightened financiers do exist, and can make this happen.

But mostly none of this happens does it? How do we know this? Because if it did the real estate industry would attract much of the very best technical talent in the world. Because the vision, the story, would be so grand, and powerful, and impactful. We’d attract those wanting to ‘change the world’. The industry would be almost the ultimate human + machine space. Where great human and technological skills complimented each other, and leveraged the capabilities of each other. Where the end product improved peoples lives.

The real estate industry has largely been fit for purpose the last 30,40 years. Because the purpose was never very exacting. For the next 30, 40 years this is not good enough. We have the need, and the opportunity, to reinvent a new industry that aims at a higher purpose. That helps save the planet by simply being better across every dimension.

If we are serious about attracting the best tech talent then we need to stop being sugar water sellers. We need to be better to build back better.

It is possible. Just find the visionaries and let them loose.

How can we help?

Michelangelo: Hands of God and Adam, Detail from The Creation of Adam. The Sistine Chapel. 1508-12

‘How can we help’ is not a phrase one hears all that often in the real estate industry. Which is not necessarily a criticism, because it applies more in service industries than it does in product based ones. And historically real estate has very much been a product based industry.

We built or bought real estate and we then tried to sell it or lease/rent it. Preferably for as long as possible, with the minimum of obligations or responsibilities after the deal was signed.

But that was then and this is now. ‘How can we help’ needs to become our new guiding light. For real estate is now a service industry. Like it or not, either our customers no longer need our products, or the only way to generate strong or outsize profits is by getting much much closer to our customers.

Adapting Steve Job’s famous phrase we need to ‘start with the customer and work back to the real estate’.

Whatever asset class you deal in, your customers wants, needs and desires are fundamentally changing. The last two years of a global pandemic has uprooted more than we can comprehend. From supply chains, to the constitution of the labour market, how people shop, how they work, and indeed how they think. The world has undergone a reset. And we cannot be sure what comes next.

So second only to starting with your customer, we need to figure out how we can operate more flexibly. How fast can we redirect our efforts based on changing market dynamics, how can our business models flex and/or be redesigned. And in terms of our real estate how can we ensure it can enable our customers to do what they need to do.

Can we ‘build, measure, learn’ and behave more like software than hardware? How do we design our spaces and places so that they can be repositioned or reconfigured in an iterative manner, and in response to changing needs? What software do we need to remove friction from our customers lives, and to enable them to easily find whatever they need, when and wherever they need it? And what services do we need to develop, to make the most of our hardware and software. As a business, what do we need to do to enable our customers to be happy, healthy and productive?

Our customers spend more than 90% of their lives inside real estate. Mostly, work, rest or play happens inside real estate. No other industry has as much contact with their customers as does the real estate industry. But historically we have only involved ourselves with providing them with four walls and a roof. But this is no longer enough. The real estate is necessary, but no longer sufficient.

What is an office? What is a home? What is shopping? What is entertainment? The meaning of all of these is morphing, and these asset classes are increasingly merging into one another. The real estate industry has built silos where we need integration. We need to re-evaluate what the purpose of the spaces and places we build is. What are the ‘jobs to be done’ of the people we are building them for? What is required for them to be happy, healthy and productive. What will give them pleasure? What will entice them? What will they pay a premium for? What mix of ‘asset types’ is needed, and what would that look like? What would it feel like?

The answer to all these questions is not obvious, or easy to compute. There is no single piece of technology that will give you an answer. Real estate is the ultimate human + machine industry. Humans alone don’t have the answer but neither do ‘the machines’. We need better machines and better humans. Success in real estate over the next 20 years will come from deep understanding of human needs coupled with deep understanding of what technology enables.

As an example, let’s take a workplace. To create, and then curate an environment that enables people to function at their maximum cognitive ability, whilst also looking after their emotional, social and functional health, is an art that requires multifunctional skills. It requires real estate knowledge coupled with IoT and data analysis, but also workplace, hospitality and HR skills. All of these are inputs to the output we are trying to optimise for our customers. Today though, they are buried in six silos, with minimal integration. Tomorrow they need to be parts of a whole, that is designed to think, feel and do. Only when we synthesise technology with the full gamut of human capabilities will we create something outstanding, memorable and deeply desirable.

What does that look like? Who knows? That is the point. After two years of a global pandemic we have the unprecedented opportunity to build new business models, with new products and services, that align with the real rather than the mandated or presumed needs of our customers. This is a time for innovation, imagination and great ambition.

How can you help?

Two Peas in a Pod: In real estate you need to Educate to Innovate

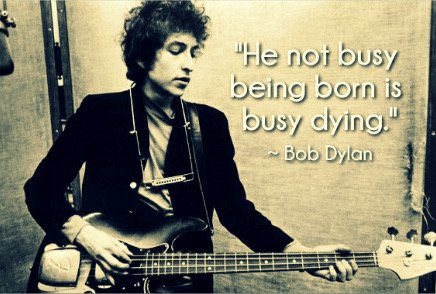

Bob Dylan: "It's Alright, Ma (I'm Only Bleeding)" 1965

Andy Grove, employee No 1 at Intel, wrote a book in 1988 entitled “Only the Paranoid Survive”. It had the subtitle ‘How to exploit the crisis points that challenge every company’.

34 years later it’s a tome for our times in the real estate industry, as we face ‘crisis points’ on many fronts.

Over the last two years the office sector has learnt what the retail sector learnt over the last 20 years: customers no longer need offices to work in, as they no longer need shops to shop in.

Which rather upsets the apple cart. The certainties of the last forty years have gone out of the window. Deciding what to build where used to be so easy. Offices go here, retail goes here, and residential goes here. Get out the cookie-cutter and away you go. Real estate was not an easy industry, but it wasn’t complicated. You asked investors what they wanted and you built it for them.

Today it most certainly is complicated. Starting with the customer. Whereas what investors wanted was all that really mattered historically, from now on what customers want, actual occupiers and users of your space, is what matters. And, to be honest, often they do not know.

Where we are heading is not an acceleration, or an iteration, of the past. It is a fundamental mistake to think where we were in January 2020 is where we will be returning to, post pandemic. At scale we have learnt that remote working, by and large, works. We have learnt what does work, and what does not work. Furthermore we have all learnt to use the technology that enables us to function as an economy at a level that very few thought possible pre pandemic.

We are now able to look at how we live and work through a different lens. One that shows us we have new options, we have new choices, and we have new needs. And we are not going to give them up.

Which is all very well and good on a personal level but as people working in real estate it does pose a problem. How DO we decide what to build where? What do our customers want? What will they pay good money for? What is an office, what is a home, what is a shop? The form factor and functional specifications of each of these is changing. Asset classes are sort of morphing into each other. Is this a permanent change? Has it got further to go? Where is value to be had?

To further complicate things, we are still in the midst of a pandemic. We have our theories about what the future might bring, but nowhere in the world is anyone operating a post pandemic economy. So do we really know anything…. for sure?

And real estate projects take a long time. It’s no use being right for the market today, or in the immediate future, when in 2-5 years, or 5-10 the market might have changed fundamentally again.

What does #FutureProofRealEstate look like? How do we create the products and services that will be in demand tomorrow and 10 years hence?

The answer is that we need to educate ourselves about the levers that are being pulled, and are available to pull, around ourselves and at the wider societal level. And then we need to use what we learn to innovate our way to new business models, new products and new services that have product/market fit, and are scaleable and flexible enough to remain relevant come what may.

So we need to:

Understand the big picture. How the meaning of location is changing, what happens when technology enables an economy of abundance rather than scarcity, whether agglomeration theory still holds, and where does this open up new opportunities.

Understand the theory behind the oft talked about notion of ‘disruption’. How market leaders can be displaced by new entrants who do a worse job than them, but do something else that customers decide they value more. How to respond to disruption, and how to develop a strategy that maintains competitive advantage.

Understand the importance of data, what data actually matters and how to get hold of it, and how to use it ethically.

Understand how the tech industry thinks, and how to apply this to real estate. And then the 5 steps to innovating with technology.

Understand how #SpaceAsAService is transforming the workplace and catalysing new business models.

Understand how technology is transforming our homes and the housing lifecycle.

Understand how to finance change. Who is going to enable all these new products, services and business models? Which sources of finance should you be using at different stages of your companies development. And above all of this understand why innovation is hard in real estate, where and why blockers exist, and how to get around them.

Understand why ESG is so important, and will be a major component of every conversation in real estate for the next decade and more. How do you develop with ESG as a north star, and why it represents perhaps the biggest opportunity ever within the real estate industry.

All of the above is what each of us needs to approach with a ‘lifelong learning’ mindset. The topics are huge and constantly evolving. Build solid foundations of knowledge and then take it from there. You’ll never know everything but knowing more than your competitors is what you should be aiming at.

Innovation is a tough business. And, like learning, never stops. As with software, it is never finished. Build, measure, learn, and repeat, is how the software industry operates. Within real estate we need to do the same. Think of real estate as software. Constantly adapting to the wants, needs and desires of humans.

The future success of the real estate industry is going to be driven by people continually learning and continually innovating. And doing so amongst other like minded people. We all have to educate each other. A hive mind of the world's most interesting, innovative people is what we should aspire to.

Real estate is at the heart of everything in society. People spend 90% of their time inside real estate. Collectively, we need to build the best built environment possible.

And besides, as Mr Dylan so brilliantly put it:

‘he not busy being born, is busy dying'.

—————————

PS. The next cohort of the Real Innovation Academy’s #FutureProofRealEstate course, where we teach all of the above, starts on the 25th of January. Please join us by registering here - realinnovationacademy.com

Storytelling is the new real estate super skill - Follow up

Bayeux - 11th Century

In yesterdays post I wrote ‘It will be hard to wean a customer off a competitor who knows them much much better than you do. It’ll be like trying to get an iPhone user to switch to Android, or vice versa. The switching cost will just be too high.’

Someone has since asked if I could elaborate on the iPhone vs Android analogy, and how high switching costs might apply in a real estate context.

So here goes.

Within the smartphone market 70% of users run the Android operating system and 29% run iOS, the iPhone’s operating system. Just 1% use something else. This has been constant for many years, as very few people swap from Android to iPhone, or vice versa. Both operating systems have very high ‘lock-in’, meaning that once a customer makes an initial decision that tends to be it. They will be a customer for life.

The reasons for this follow a pattern in the tech industry where the ‘switching costs’ for a consumer to move from one technology to another rise over time. The more a technology becomes tuned to the specific needs of individuals the harder, or more painful, it becomes for them to cast what they know aside and learn, and teach, another technology what works for them. This function of lock-in explains why companies can afford a high ‘customer acquisition cost’, because once a customer, their ‘lifetime value’ will be very high.

What is really instructive within the smartphone market though is that despite the much smaller market share, Apple, via the iPhone, make easily the most profit. For example, in Q2 2021, only 13% of global handset shipments were iPhones but these generated 40% of total revenue and an extraordinary 75% of operating profit.

Why is is? It is because the iPhone is a much more tightly integrated package of hardware, software and services than any Android phone. Apple ruthlessly control the user experience of their devices. Indeed it is the user experience offered by the iPhone that gives Apple so much pricing power. They have spent years creating and curating this user experience and it is this which most customers buy in to. An iPhone is an emotional rather than functional purchase, and this has allowed Apple to pretty much own the high end of the market. In Q4 2020 the iPhone had 65% market share in the US. Most of the expensive, high margin smartphones purchased globally are iPhones.

Which explains why I advocate so strongly for real estate people to think of ‘Office as iPhone’. Where instead of just thinking about the ‘hardware’ of real estate, one thinks about the overall user experience of space that can be delivered if one controls the hardware, software and services of any space, or place. Where one designs ‘workplace as software’ that is never finished but is constantly being iterated based around the mantra of build, measure, learn. You build something, you measure how well it performs against specific criteria, you learn from this data, and then you re-build. And you repeat this constantly. A tweak here, a tweak there, on a rolling basis, based on feedback from users, and from the building itself.

The UX, or user experience of real estate is a function of qualitative and quantitative factors. And there are many of these that need to be tracked. But in essence it is a matter of understanding how individuals ‘feel’ that their workspace is enabling them to perform as best they can (the qualitative factors) and how the workplace is performing in environmental terms (the quantitative factors). Critical amongst these are temperature, noise, lighting, and air quality. To what extent are these perfectly optimised to allow every individual the opportunity to perform their ‘jobs to be done’ with their maximum cognitive firepower? Put simply, the environment we are in impacts on our cognitive function. If we can put our customers in environmental conditions that have no detrimental impact on their cognitive function, then we are enabling them to be as productive as they are capable of being.

With our real estate hats on we cannot make a badly managed company better, but we can at least not make things worse. For a well managed company we definitely can help them be their best. The key point is that no company actually wants an office; what they want is a productive workforce. Our job in real estate is to help make this happen.

So, returning to the original question of how switching costs might manifest themselves in a real estate context, the answer is that by thinking of real estate as hardware, software and services, by continually monitoring defined KPIs, and then on an ongoing basis optimising the space based on this data, we can provide our customers with workplaces that are finely attuned to their specific needs. We can provide demonstrably better working environments than if we did not operate in this way. And over time, this knowledge will act as a ‘lock-in’ to our customers. They could go elsewhere, but then they’d need to start again in training the space to function in an optimal fashion.

Put simply, space that is optimised for you, is hard for you to give up.